EFB Newsletter Summer 2021

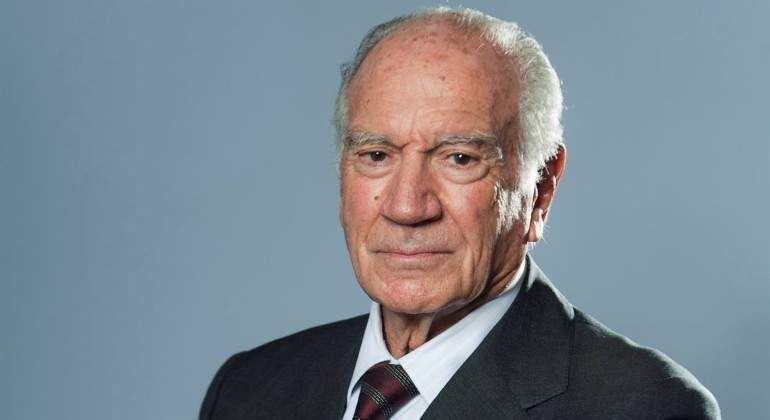

Mariano Puig (1927-2021) - Founder, Philanthrope and role model

It was with great sadness that we announced on the 13th April that our dear Founder and Honorary President, Mr Mariano Puig, had passed away at the age of 93. Mr. Puig was a second-generation member of the Puig family and former president of Puig, the multinational fashion, perfumery and cosmetics company. Born in Barcelona in 1927, he was married and has four sons and one daughter. At EFB, we will always remain grateful for his support and dedication to our cause since the very foundation of this federation in 1997, with the respect and recognition of the whole community of European family business owners. Those who knew him will always remember him as a great man, a leader, a friend, and a true visionary, who always treated everyone with great affection. His passion will continue to inspire us, our families, our businesses and our community for many generations to come. His elegant manners, taste for the details and diplomacy skills have definitely set the basis of what EFB stands for now.

Upcoming for the third quarter of 2021

In the third quarter of 2021, EFB will be releasing several position papers. Currently planned for release are EFB’s position papers on:

- Sustainable Corporate Governance

- The European Commissions “Fit for 55 Package”

- EFB will furthermore provide you with a Constant Follow up regarding the Debt Equity Bias Reduction Allowance (DEBRA)

New EFB Brussels Team Member

In April this year Mr. David Breyer joined EFB as Junior Policy Advisor replacing Mr. Matthew Lynes. Mr. Breyer monitors legislation and initiatives concerning Family Businesses, as well as writing the EFB policy position papers and responses to consultations and legislation. He will be assisting in event organisation, communications management and representing EFB at meetings with various stakeholders.

Mr. Breyer studied at the University of Saarbrücken and the University of Trier-Germany and holds a BA in History and Business studies as well as a MA with Honours from University of Rostock in International Politics. At his last position, he worked at the European Parliament in Brussels.

As a young professional specialized in international relations, EU politics and communication with experience from the European institutions and numerous international assignments over three continents Mr. Breyer will be a great asset to our organisation. EFB wishes him every success in the fulfilment of his upcoming tasks.

EFB Summit 2021

For the first time, EFB’s annual Summit took place online. Entitled the “European Family Business Week”, the Summit took place between the 25th-28th May 2021. Each day, EFB hosted a discussion, exploring a different topic area with top level policy makers, family business owners and academics to share their expertise with top family business owners from across Europe.

You can find a short highlights video here: “EFB-Week 2022”.

In his opening speech, EFB President Mr Udo J. Vetter pointed out that Family Businesses across Europe have shown that they have the resilience and responsibility to deal with the pandemic across Europe and their philanthropic activities have been thrust into the limelight. Even in these vulnerable times, the network of Family and Mid-Size Businesses has proven to be one of the most robust pillars that sustain the European Economy.

One of the highlights of the 2021 Summit was the interview with European Commission Executive Vice-President Valdis Dombrovskis. With regard to the Commission’s strategy to support companies through EU recovery funds during the ongoing Covid-19 Pandemic, VP Dombrovskis pointed out that all upcoming European Commission measures will target support to Family Businesses, SME´s and Entrepreneurs.

On business transfers, VP Dombrovskis shared a clear message to the audience, ‘the European Commission has realized the importance of reducing possible barriers to successful Transfers of Business for family businesses.”

Please find EFB’s Press release on Vice President Valdis Dombrovskis’s intervention – “EU trade agenda can help European companies to accelerate their recovery from Covid-19“:

Mr. Andrew Keyt, Clinical Professor in Family Businesses, President of Keyt Consulting, delivered his talk on “Legacies that last: Sustaining values in the Next Generation”. Mr Keyt delivered deep insights into the hidden impact of Family Businesses beyond the numbers and financials. He pointed out the huge contributions made by Family Businesses and showed some clear examples and facts considering their importance. Mr Keyt then gave some thought-provoking insights on values as the foundation and one of the main pillars of every Family Business. Furthermore, he reflected on some of the most pressuring challenges for Family Businesses in modern times.

The Second day was kicked off by Tom McGinness, Global Leader of Family Business for KPMG Private Enterprise. Tom delivered a presentation on the results of the STEP/KPMG European Family Business Report: Covid-19 edition.

Tom highlighted the fact that Family businesses are making a vital contribution in restarting the economic engine in Europe. In addition, the survey results dispelled some of the myths that surround family businesses, notably their inability to be agile and their overly cautious nature. Tom concluded his intervention by urging family businesses to utilise this moment, post-pandemic, to reflect on their role and contribution to society. Finally, family businesses need to be more vocal about what they do and better communicate in future.

Please get the full Report here.

The second session of the day saw a high level family business expert panel on “Regenerative succession for recovery and growth”. First the moderator of the session, Mr Panikkos Poutziouris, presented the SPRING project, Salvatore Tomaselli followed by explaining that that almost every family business has experienced administrative and social difficulties during the pandemic. He added, one of the biggest challenges in the future for family businesses, will be the massive increase in speed of technological evolution, even outside of production chains. Artificial Intelligence will accompany all future business processes and the main challenge will be to think ahead. Ms Rania Labaki pointed out that one of the main characteristics of family businesses is long term decisions making and thinking in generations. Therefore, it would be even more crucial for Family Businesses to clearly define for their own wellbeing, which kind of problems were Pandemic-made and which ones were already in place. Inter-generational differences around general conception and futural outlook should therefore clearly be separated from the post-Pandemic recovery. Peter Jenner pointed out that family businesses are crucial for the after-Covid-recovery. He closed by noting that the European commission has to focus on a simplified and more state of play orientated ”transfer of business” procedure to keep the family business as the backbone of the EU-economy.

In the first session of the third day, Heinrich Lichtenstein presented the latest scientific evidence and research surrounding the topical family business issue of “values and purpose”. Heinrich noted that the evidence shows that the importance of ‘purpose’, within businesses, has increased massively over the last years. John Learmonth followed by sharing the latest research data on the “top ten values and purpose communicated by the most “open” European Family investment companies.” He showcased their shared attributes in structure, strategy, and stories. He also referred to the combined effects of these key elements. The floor was given to Franz Haniel who gave great insights from his experience as a current board member and family shareholder for many years. He gave fascinating insights on how to ensure that values and purposes that have been created for many years, keep staying in a family business with all employees and shareholders. A special focus on the necessary inside company-communication and the basis of behaviours for generations, completed this presentation.

In the second session of the day the audience got the possibility to join a high-level panel on two of the most pressing topics for Europe. Regarding the possibilities and risks of the “Green Deal” and the “New Industrial strategy”, Mr Lamberts MEP noted that he thinks the European Green Deal will be the only way for the European economy to maintain its importance in the future. Cost competitiveness would have to be replaced by value competitiveness. Ms Jorna recognised that the decarbonisation effort cannot be made from an office in Brussels. Family Businesses and companies are the key players in reaching the ambitious goals of the Green Deal. The European Commission could via funding, legislation and optimisation of supply chains and competition, support a reasonable sustainable transformation of the European economy in all sectors. Following these statements, Mr. Vetter pointed out that the targets, set by the Commission, would have to stick now unchanged to give businesses a clear way and fix point to follow. Insecurity would have to be avoided at every level to guarantee healthy growth for businesses all over Europe. Mr Vetter declared, these changes must not come about with a “revolution”, but by a clearly managed and defined “evolution.”

On the final day of the “European Family Business Week”, Mr Paul Scheffer, Professor of European Studies, Tilburg University gave some very interesting thoughts on “The Hidden Vitality of Europe”. Paul Scheffer’s intervention was primarily focused on the prevalent negative narrative surrounding Europe and its future. For example, European integration is often discussed in the context of decline. Making reference to EFB’s 2019 paper on the future of Europe, Paul explained that if Europe wants to start addressing some of its key challenges, it should begin to take a generational perspective, as family businesses do. Paul suggested that there is a growing tendency in Europe towards protectionism and insular thinking. As such, it is vitally important for Europe to find the counters to these sentiments. Indeed, Paul noted that Europe still has a lot of things to be proud of and positive about. For example, Europe still has more Universities in the top 200 when compared with places like the US, China, and Russia. When you look at scientific indicators, Europe scores highest in social equality and also has a vibrant urban culture with comparatively low levels of segregation. Therefore, Paul argued, the negative narrative surrounding Europe is faulty and disingenuous. He added that Europe must also address some underlying issues to secure its future, notably: completing the single market; clarifying the relationship of responsibility and solidarity between Member States; ensuring that the common external border is secured.

EFB’s summit in 2022 will be held in Berlin, in partnership with our German Chapter Die Familienunternehmer and we look forward to once again meeting our members and business owners across Europe then, hopefully in person.

KPMG report: “Taking the long view”

On the 26th of May, KPMG Private Enterprise launched its European family business report: COVID-19 edition. The launch took place during an exclusive session of the EFB Summit.

COVID-19 has had an impact on businesses of every size and type and in every region of the world. Family businesses are no exception and we wanted to find out if their characteristic resilience, agility and entrepreneurial spirit have helped them navigate a more successful route through the unpredictability of the global crisis. The STEP Project Global Consortium, KPMG Private Enterprise and European Family Businesses (EFB) came together to find out how family businesses have been affected and responded in the Global family business survey: COVID-19 edition, and a close examination of European family businesses specifically. Together, we have examined the initial impact on family businesses, the actions they have taken, and their longer-term outlook for the future.

The initial shock

Not surprisingly, the first commercial shock of the pandemic was felt on companies’ revenues worldwide and family businesses in Europe were no exception. As many as 64 percent of European family businesses reported a decline in their revenue, though they fared better than the global average of 69 percent. Eleven percent of European family businesses actually experienced a revenue boost.

The aftershock

Business families responded immediately to address the impact on their businesses, then turned their attention quickly to the longer-term outlook and value of their businesses. Their responses were seen in three primary activities: stabilizing their business, accessing external support (particularly through government programs) and by taking a long-term view and potentially reimagining the future for their companies.

Stabilizing the business

To stabilize their business in the short term and keep it on a steady course for the long term, many family businesses took cost-reduction measures to address the immediate drop in their income and the impact it had on their cash flow. In some cases, these measures included employment-related changes, such as moving employees to remote working status, which suggests they were able to adapt and adopt digital solutions quickly to transform their business operations. It was notable that European family businesses were less likely to reduce their employees’ pay compared with those in other world regions. The actions taken to maintain employment as much as possible reflect the business families’ characteristic commitment and loyalty to their employees. With revenues in decline, however, it was also necessary for many companies to reduce their general office expenses, cut back marketing, reduce inventories and, in some cases, defer the launches of new products or R&D investments. Unlike family businesses in other macro-regions of the world, Europe’s entrepreneurs were more likely to raise additional capital and take on more debt to maintain their independence and control. Compared to others globally, European family businesses reported fewer business closures, with 15 percent closing their businesses temporarily (compared to 16 percent globally) and less than 1 percent who closed their businesses permanently. Family businesses in Europe were also less likely to make adjustments to executive compensation, such as reducing their pay levels, deferring payments or considering alternative compensation arrangements.

To read the full report, please follow the link.

Joint Letter regarding the EC initiative on Sustainable Corporate Governance – European leading associations share their views on upcoming initiatives.

On the 3rd of May, EFB, along with consortium of other organisations (BETTER FINANCE, ecoDa, EuropeanIssuers, Federation of European Securities Exchanges (FESE), Invest Europe and SMEUnited), submitted a letter to the European Commission regarding its upcoming initiative on Sustainable Corporate Governance. In our communication, we laid down some of the concerns we share on what actions the Commission has suggested it might pursue.

In our joint letter, the signing organisations:

- supported the concept of sustainable corporate governance as a means to reconcile economic growth, social progress and environmental protection.

- acknowledged the aim of encouraging boards to consider their relevant stakeholders as having intrinsic value for decision-making in the best interest of the company over time.

- encouraged the Commission to further pursue strengthening shareholders’ active participation in the governance of companies.

But, we also highlighted that:

- the two topics of due diligence and corporate governance should be treated separately, and that the European Commission should avoid an oversimplified, one-size-fits-all approach.

- taking into consideration many interests is a natural part of directors’ duties, and that principles related to this are already included in many corporate governance codes.

- an EU initiative in this area which goes beyond the form of recommendations would be counterproductive.

EFB will continue to follow the development of this crucial Commission initiative, which is expected to be published in the autumn.

To read the press release please visit.

EFB Position Paper on “Family Business Transfers: Let the Next Generation drive the Recovery”

At the beginning of the year, EFB highlighted that the COVID pandemic has accelerated the frequency of business transfers in Europe. EFB maintained that Europe needs to recognise the huge opportunity for growth, resilience and recovery that business transfers represent. The next generation of business owners are ready and willing to take over and are prepared to drive the sustainable and digital transition that our continent needs for the future.

To ensure that we give the next generation the best chances of succeeding, EFB noted that the EU needs a strong legal and regulatory framework for these business transfers to occur. The next generation will drive the recovery.

EFB called on the European Commission to continue to act as the catalyst to ensure that family business owners are made aware of the resources and tools that are available to them to better prepare their transfers. Furthermore, Member States must enact national action plans to facilitate the transfer of business.

To get the full publication please follow the link.

Family Businesses: The pioneers of Sustainable Corporate Governance

In February, EFB released its position paper on the upcoming Sustainable Corporate Governance initiative. In our paper, we noted that Sustainable Corporate Governance is at the heart of any good family business. Furthermore, we highlighted that, because of a culture of responsible and generational ownership, sustainability is built into family businesses and is propelled through the values that guide family firms.

Whilst European Family Businesses fully supports initiatives that would encourage all companies to adopt more sustainable practices and help instil effective corporate governance, we argued that the European Commission needs to adopt a cautious approach to regulating corporate governance. A prescriptive and overreaching proposal would make life more difficult for long-term orientated, responsible businesses.

Please read the full Position Paper here.

SPRING

The series of free webinars for family businesses was completed successfully!

On Tuesday 02.03.2021 the series of 8 free webinars for family businesses funded by our European project SPRING was completed. The series consisted of approximately 20 hours of free training to help family businesses grow in a post-COVID-19 world, provided by a team of family business experts from 9 member countries of the European Union.

The programme included among other topics:

- Strategic development of Family Business across generations

- Managing intergenerational dynamics

- Practical lessons from COVID-19

- Family Business recovery post-pandemic and the next generation

- The succession process

More than 240 people from 139 family businesses operating in 44 countries in Europe and beyond registered for the series. Overall participants found the webinars interesting, informative, and very practical with lots of examples that one can easily relate to and apply to his/her own business.

If you would like to see a recap of all webinars, click here.

All the webinars were recorded and will soon be uploaded on the project’s eLearning platform. All EFB members and businesses across the family business community are invited and encouraged to take part in these programmes which are a great resource for family businesses and act as a great training module for business owners and next generations alike.

To sign up, head to https://www.euspring.eu/webinars

SUFABU

https://www.sufabu.eu/4rd-transnational-project-meeting-in-beautiful-florence/

On 7th and 8th April, the fourth transnational meeting of the SUFABU Project looking at succession in family businesses, organised by the project’s Scottish Partner Dundee & Angus College, took place on a hybrid platform due to COVID-19 travel restrictions. All partners, including EFB’s team joined the meeting online.

The transnational meeting was divided into a series of three online meetings, each lasting two hours.

The key element to the fourth Transnational Project Meeting was reviewing and providing feedback on the learning materials developed during Intellectual Output 3. Each completed module was reviewed and discussed, and partners were left to make amendments before the piloting of the materials commences. In addition, the partners took part in and enjoyed a workshop looking at the micro-learning units to be developed – taking the form of short educational videos. Following an active brainstorming session, the project partnership came up with 10 short videos containing a professional English language voice-over which will be subtitled into each partner required language. The meeting also clarified the structure of these short videos to ensure they are engaging and provided quality learning in this interesting short form. It was agreed that the partnership would create a YouTube channel once the videos were created to share the content with the public.

Once the video content has been created, we move into Intellectual Output 4 which is the piloting (testing) of the learning materials. It is expected that the piloting will take place over the summer period.

The project partnership is always looking for new family businesses to work with so should you like to be involved, please do get in touch with us.

The fifth transnational meeting of the project is scheduled to take place as an online meeting in Brussels on 23th – 24th September 2021.

The final SPRING coordination meeting and grand dissemination event will take place in Cyprus between the 16th until the 18th of November.

A word from our sponsors: Bank Julius Baer & Co. Ltd:

We are pleased to announce the good news of a sponsorship agreement with Bank Julius Baer.

Julius Baer is the leading Swiss wealth management group and a premium brand in this global sector, with a focus on servicing and advising sophisticated private clients.

At the end of April 2021, assets under management amounted to CHF 470 billion. Bank Julius Baer & Co. Ltd., the renowned Swiss private bank with origins dating back to 1890, is the principal operating company of Julius Baer Group Ltd., whose shares are listed on the SIX Swiss Exchange and are included in the Swiss Leader Index (SLI), comprising the 30 largest and most liquid Swiss stocks. Julius Baer is present in over 20 countries and more than 50 locations.

The client-centric approach, the objective advice based on the Julius Baer open product platform, the solid financial base and the entrepreneurial management culture makes Julius Baer the international reference in wealth management.

We at EFB are looking forward to building upon our new partnership in many successful projects and thank them for their support.

KPMG: How family businesses can accelerate ESG

In the space of one-year, social awareness has escalated and brought the world together in dealing with the health, financial and commercial impact of COVID-19. The way businesses work has changed. How they engage with other people has changed. Their expectations of the companies with whom they choose to do business have grown and intensified. This has energized businesses of many types to reflect on their purpose and values, their capability to deliver what really matters and to do so in a financially, environmentally and socially responsible way. The importance of a company’s purpose and its role in making the world a better place for today and for future generations have come into stark relief throughout the pandemic. The result is that more companies are taking a deeper look at their businesses to understand the impact of their actions across a spectrum of their stakeholders. While the acceleration of digital transformation during COVID-19 has garnered a great deal of media attention of late, I believe the transformation of many companies’ entire business operations are being accelerated through the ESG lens. A long-term mindset, sense of purpose and the importance of creating and sustaining a legacy are already central to how family businesses define success. It is built into the DNA of every generation and has guided how they have conducted business and addressed the needs of their stakeholders for decades. For this reason, I believe that family businesses are in a prime position to influence how companies go about reshaping their business operations through purpose-driven leadership. As one family business leader summed it up, “ESG is not a series of special projects. This is a reflection of who we are and how we choose to do business.” I am beginning to see a new ESG perspective among family businesses themselves. They already have a well-established, purpose-driven mindset. Social concerns have historically been very important to family businesses as a reflection of the family’s values, and in response to COVID-19, their philanthropic activities and stakeholder commitments were heightened even further and that is unlikely to change. Similarly, governance has always been high on the agenda for family businesses in balancing the needs and actions of both the business and the family. Family businesses with the strongest governance practices generally performed better throughout the pandemic because they already had thorough procedures and mechanisms in place to identify and manage unexpected risks. Even so, those practices were put to the test in many family businesses and found to be inadequate for anticipating the risks on the scale of a global pandemic. As a result, COVID-19 has helped to accelerate the evolution of the ESG agenda in family businesses. The revolution in digital technologies combined with the pressing need to adopt more robust environmental, social and governance practices has motivated more business families to begin reimagining the future. I believe this self-examination is due, in part, to the increasing influence of next-generation family members who are embracing ESG because it fits so well with their values. They see the vital role that it can play in transforming their businesses and making their success more sustainable. They also understand the value that technology brings to their business operations by introducing advanced solutions for collecting and analysing essential data for anticipating risks, gauging the success of their company’s business strategy and measuring the impact of ESG initiatives. With these advanced analytical capabilities, I expect to see changes ahead in the priorities and actions of family businesses and an increased focus on the environmental impact of their operations in the fight against climate change. Not only are these some of the right things to do, but business families have also recognized the commercial imperative of ESG. Concrete strategies and actions around environmental, social and business oversight concerns are fast becoming competitive factors that are affecting many companies’ ability to win new business. This new competitive reality was reinforced to me recently by the executive of a family-owned construction firm who described how his firm had lost a tender bid to a key competitor specifically because their company had a more embedded ESG strategy. The urgent need to achieve greater sustainability in the world and in many businesses is putting ESG at the center of the impetus for change. It is also helping to create the imperative for a new kind of leadership that focuses on the sustainability of the strategies that businesses adopt and the impact of their collective actions. Before embarking on this important ESG journey, I believe there are two important questions that family businesses should consider:

- What is the most important goal they want to achieve? For example:

- Creating an ethical supply chain

- Satisfying customer choice

- Decarbonization to reverse climate change

- Accessing sustainable finance

- Where might they need to invest to support their ESG strategy? Such as:

- Advanced technology and data

- People and pay

- Corporate reporting

- Local community relationships and partnerships

There is no question in my mind that the pandemic has been transformational on many different levels. It has also increased an appreciation for the fact that family businesses are in it together to address the impact they are having on the world and what they are leaving behind for future generations. I believe it is imperative that they get the answers right by leading with purpose and the actions they choose to take. Interested in learning more about how KPMG Private Enterprise can help to guide and support you in developing the right ESG strategy for your family business? Contact your KPMG Private Enterprise adviser or find a KPMG Private Enterprise Family Business adviser.